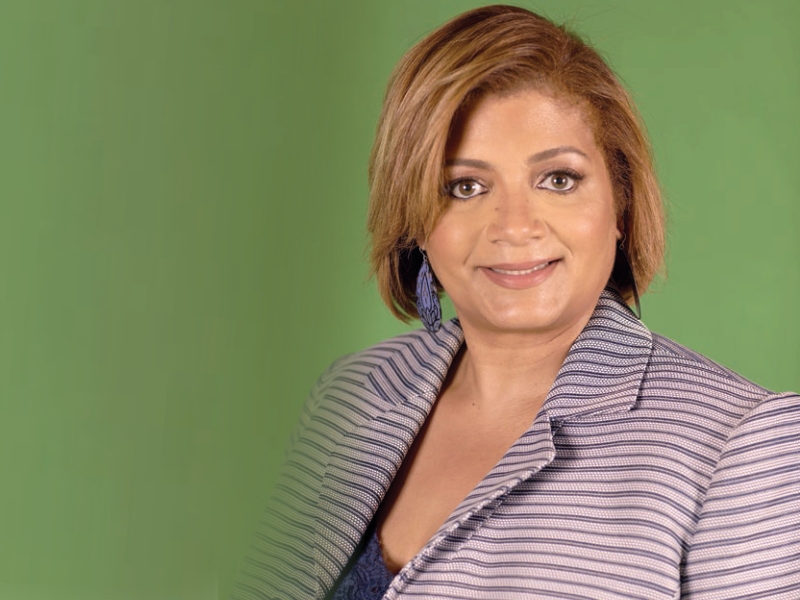

Dorinda Walker: Planning for the Future

Story By: Amanda Casanova

"I have a passion for helping to ensure that women and multicultural consumers are educated and provided with access and resources to accumulate wealth and leave a legacy"

Dorinda Walker has had people tell her they have planned for the future and bought life insurance. She’s had people tell her they’ve created a trust for their grandchildren’s college fund or invested in their retirement, and for Walker, those conversations are the most rewarding part of her job.

“These things are what it’s all about for me,” Walker said. “It’s about helping consumers achieve the American dream by having financial security and peace.

“I have a passion for helping to ensure that women and multicultural consumers are educated and provided with access and resources to accumulate wealth and leave a legacy,” she said.

Walker started as a temporary employee nearly 20 years ago before climbing to her role as the vice president of consumer strategy, key initiatives, and multicultural marketing at Prudential Financial, Inc. In her position, she helps U.S.-based businesses engage with women and diverse consumers, such as Latinos.

“The Latino community is a strong family and values culture,” she said. “Yet it is still underserved when it comes to important financial solutions that protect family and legacy of loved ones.” A 2014 Prudential research study found that more than half of the Hispanics surveyed said they had a “poor” or “very poor” understanding of workplace-based retirement plans and Social Security. The Hispanic American Financial Experience study also showed that Hispanics have less access to workplace retirement plans than the general population.

“The top reasons for not contributing to workplace retirement were other financial priorities, such as paying down debt, the perception that there was enough income to save, and not tying up their money in case they need it,” she said.

But financial planning should be a priority, Walker said, and that’s why Prudential is hoping to reach more Hispanics by partnering with Latino professionals and events, such as Hispanicize, an annual gathering of Latino journalists and bloggers.

“The number one solution we’re working to address is providing greater access and engagement,” she said. “Our collaboration with Hispanicize, Hispanic Federation and other key influencers and community-based organizations who serve the Latino community help us to drive deeper engagement and awareness about Prudential and our financial services and solutions.”

Walker said that teaching Latinos about financial planning should lead to more investments in their future. “I hope to see more Latino consumers gain a deeper understanding and education about the need for life insurance and take the action to purchase it,” she said. “Life insurance is a great vehicle to ensure the transfer of wealth and leaving an inter-generational legacy.”

According to the study, only about 28 percent of Hispanics have a life insurance policy through their workplace, compared to nearly 50 percent of the general population. About 25 percent of Hispanics have purchased individual life insurance policies.

The study also showed that 20 percent of Hispanics said they did not have retirement plans, bank accounts or life insurance and only 15 percent said they were currently working with a financial adviser.

“Our strategy is simple— to provide a complete and engaging educational experience, to create a better understanding of the need for financial planning, and demonstrate the importance of working with a financial professional,” Walker said.

As part of the drive for education, Prudential also partnered with The BOSS Network and DiMe Media to educate and inspire multicultural women entrepreneurs.

“Working with DiMe and The Boss Network is fantastic,” Walker said. “It gives Prudential a way to engage with women around the country. We had discussions about entrepreneurship, women, and money, motivating moms. There were laughter, tears and great relationship building.”

The 2017 Boss Network’s Ladies that Lead Tour will finish on Oct. 26 in Newark after visiting Houston, Los Angeles, and Baltimore.

“One of the key things we learned was that women are fearful of the unknown,” Walker said. “We heard things like, ‘I’m terrified something will happen to my spouse. My kids and I won’t have the financial means to maintain our status of living.’”

And just like in the Hispanic American Financial Experience study, Walker said retirement planning wasn’t a top priority for the women because of other financial obligations.

“We also learned that retirement planning was deprioritized,” she added. “Although they have the need and desire to save more, they just haven’t been able to get started.”

Because of that “need and desire,” Walker said Prudential would keep working with other influencers and brands that specifically target Hispanics.

“We’ll continue to invest in research to better understand the financial challenges and needs of the Hispanic community,” Walker said. “We’ll make efforts to recruit Hispanic talent that understand the needs and cultural nuances of the Hispanic community.”

But it will not be a single strategy to reach out to Hispanics.

While the research shows that many Hispanics need better financial plans, Walker said connecting with those Hispanics might not have a single approach.

“Companies that want to engage the Latino community need to treat them as a diverse group that they are. They’re not a monolithic, one-size-fits-all group.”

“A marketing strategy targeting Hispanics in New York may look very different than a marketing strategy in Texas.”

For now, many Hispanics prefer family advice on finances to the advice of a professional, according to the study. However, Walker said, a financial adviser can help Latinos build their wealth and plan for the future. Consumers can also check the background of a possible financial adviser at the Financial Industry Regulatory Authority (FINRA).

“Don’t try to figure it out by yourself,” she said. “Seek the services of a financial professional. There’s a tremendous value in developing goals and working with a knowledgeable professional to help you develop a comprehensive financial plan. They are trained and knowledgeable and can assist you to develop a strong financial foundation.”